4. Bankruptcy Court Judges

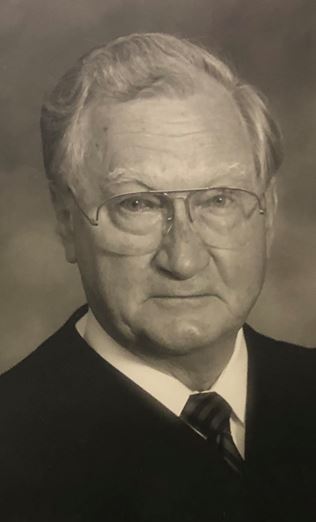

Located: 1st floor, alcove outside Clerk’s Office and Courtroom APrints in courthouse exhibit: Judge Betley, Judge Yacos

Bankruptcy judges serve as judicial officers of the United States District Court. They are appointed to fourteen-year terms by each circuit’s court of appeals, with the assistance of a merit selection panel.

Bankruptcy Court Judges

Bankruptcy judges serve as judicial officers of the United States District Court. They are appointed to fourteen-year terms by each circuit’s court of appeals, with the assistance of a merit selection panel.

As early as 1800, Congress authorized “commissioners” (and later, “assignees”) to supervise the process of liquidation and distribution in bankruptcy cases before the district court. For most of the nineteenth century, however, federal laws on the subject of bankruptcy were just short-lived, temporary enactments in response to specific financial crises. Some industrialized states established their own bankruptcy laws and procedures. While these various laws mainly served the interests of creditors, protections for debtors were gradually introduced. From 1867 to 1878, Congress permitted the district courts to appoint, as needed, “registers in bankruptcy, to assist the judge … in the performance of his duties,” with assignees still coordinating the terms of liquidation. The Bankruptcy Act of 1898 finally established the federal district courts as the “courts of bankruptcy” and created the part-time position of Bankruptcy Referee, appointed by the district judges to assist “in expeditiously transacting the bankruptcy business.” The Act provided a framework that would remain in effect for 80 years, albeit with substantial and numerous amendments.

As the nation’s bankruptcy system grew in scope, so did the responsibilities of the appointed referees. Numerous amendments to the Bankruptcy Act came about in the 1920s and 1930s. Policies encouraging an honest individual debtor’s “fresh start” emerged, and a preference for re-organization rather than liquidation of troubled businesses also took hold. In 1938, Congress passed the Chandler Act, which introduced the designation of specific types of bankruptcies by “chapter.” District courts depended on referees with a comprehensive understanding of the increasingly complex bankruptcy laws, and an ability to exercise essential judicial functions in managing cases. By the 1940s, the fee-based compensation scheme for referees was changed to a fixed salary, and their tenure of appointment was increased from two to six years.

With very few bankruptcy cases filed each year, New Hampshire’s federal court was slow to develop a system to handle them. Until 1945, the presiding district judge heard an average of just four bankruptcy cases each year. That year, New Hampshire’s first referee in bankruptcy was appointed. Referee Joseph Betley prided himself on having the smallest and most cost-efficient bankruptcy court in the nation. For 38 years, Referee Betley handled the New Hampshire district’s bankruptcy cases, and held hearings, in a room within his private law office in Manchester, which also housed the bankruptcy clerk’s office. If a courtroom was actually needed, he (never one to wear a robe) would unceremoniously stroll down the street to use the local Probate Court.

In 1973, the United States Supreme Court’s new Rules of Bankruptcy Procedure recognized the inadequacies of the term “referee in bankruptcy,” referring instead to the “bankruptcy judge.” This change was incorporated by the Bankruptcy Reform Act of 1978. Judge Betley served until his unexpected death in 1983, just one day after New Hampshire’s bankruptcy court, chambers and clerk’s office moved to new quarters in the Norris Cotton Federal Building in Manchester.

The bankruptcy court, now located in the Warren B. Rudman United States Courthouse in Concord, has one authorized judgeship. The bankruptcy judge is responsible for determining the eligibility of bankruptcy filings. The judge must also rule on motions and petitions filed throughout a case, to ensure that the administration of a bankruptcy filing is conducted according to federal and local rules. While many aspects of a bankruptcy case are negotiated in conference with an appointed trustee, the bankruptcy judge is called on to decide contested matters that arise. When necessary, the judge presides over trial proceedings, which can include a jury trial.

The United States Bankruptcy Court for the District of New Hampshire has its own Clerk of Court and support staff.

Photographs of past judges for New Hampshire’s bankruptcy court are displayed here.